The 2020 Freightpocalsype and Seven Takeaways for Amazon Sellers

- Jon - Black Label Advisor

- Apr 21, 2021

- 7 min read

Updated: Feb 11, 2023

The statistics are burnt into our brains by this point, forged by the power of 10,000 excited Axios and Business Insider headlines. COVID pushed ecommerce forward by about 10 years in just under three months. Everyone was online. Everyone. Even my grandmother.

And massive layoffs combined with bored people stuck at home sparked an ecommerce gold rush.

The US Census saw a massive 83% growth in new businesses registered in the US during Q3. While not all of them were ecommerce businesses, a huge chunk were. US ecommerce penetration increased by 49% in Q2 2020 and, of course, Prime Day third-party sales increased 60%. It was a big deal.

But in gold rushes, those who benefit are pickaxe manufacturers - and the faster goldrushers (I might have made that word up). The ecommerce spike wasn’t easy for most sellers, even the most experienced ones. Major hurdles appeared everywhere, and nowhere was this more visible than on the logistics and supply chain side of things.

I say this from first-hand experience.

I’m the Chief Marketing Officer at Freightos, a digital freight marketplace that supports small importers (especially those importing to FBA centers) and is a logistics technology provider to over 2,000 global logistics providers. With a few exceptions, the following data and insights are all based on the cold hard facts we have seen across our platform.

Spoiler alert - while it starts out fairly bleak, by August 2020 imports were back up to 25% over the same volumes the year before, so this story has a relatively happy ending.

Before we dive into how to make - and keep - things shipshape, let’s first talk about where 2020 went wrong for Amazon FBA seller supply chains , both in terms of Amazon policies that impacted FBA sellers and in terms of global freight.

Part I: The Amazon FBA Policy Changes

COVID hit domestic United States supply chains in early March. While the Chinese New Year froze manufacturing for far longer than anticipated because of local Asian shutdowns (more on this soon), by early March, manufacturing had started to return and all was well. In fact, inbound shipments to FBA centers on our platform increased by 20%.

That is, until US COVID restrictions went into effect. Ecommerce spiked...and Amazon promptly shut down inbound shipments for non-essential goods.

This was, to put it mildly, a wakeup call. Sellers that were all in on Amazon fulfillment had the chair kicked out from under them, just when ecommerce was taking off.

Some of the restrictions were lifted in early May, but things got worse again. Fast. Following the frantic pace of ecommerce, Amazon moved into overdrive and in July, in the build up to the holiday season, imposed restrictions on the number of new SKUs that could be shipped to its fulfillment centers.

Here’s how this played out:

The International Freight Component

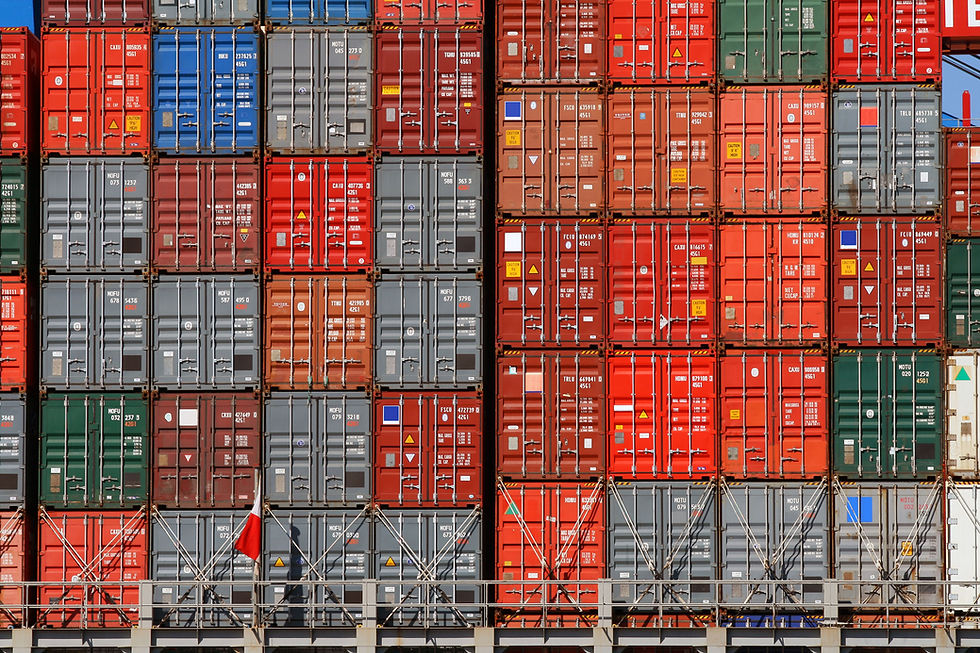

One thing unified the smallest Amazon seller with giants like target and Ikea - international freight challenges. Even before the Ever Given blocked the Suez Canal (but unleashed memes galore), COVID meant ship hit the fan for international freight.

Let’s start with air cargo, which moves over 30% of world trade by value. With over half of all air cargo moved in the holds of passenger planes, when people suddenly stopped traveling, so did over 50% of air cargo capacity.

Inevitably, air cargo prices started to climb, increasing by over 400% before holding steady there. To keep up, airlines converted passenger planes into dedicated freighters, but it was hard to stop the price climb.

On the waters, ocean freight stayed shockingly stable. In hindsight, it’s clear that 2020 was a bumper year for global trade. People stuck at home started to buy products (yes, I’m looking at you, Mr Been-Wearing-Sweatpants-For-One-Year) instead of services and by Q4, imports were up. Way up.

However, as imports came back on track, so did ocean freight challenges.

A massive influx in demand for shipping caught many by surprise. Shortages in containers to ship built up and, when combined with COVID-driven port shutdowns, ocean freight prices shot up and stayed up.

Picture the Ever Given.

Now imagine 38 massive ships like it waiting to unload their cargo but instead forced to sail aimlessly (and expensively) around the Port of Long Beach because of port congestion.

Not to get all Economics 101 but when there’s high demand and low supply, bad things happen to prices. And they did. Between May 2020 and March 2021, ocean freight rates from China to the United States climbed by over 300%.

High prices weren’t the only problem from importers. In many cases, they couldn’t secure space on a container, meaning their goods were stuck in China and their Amazon inventory dwindled. Multinational companies suffered from the same problem; Peloton bikes famously needed to air freight in their bicycles to hit their targets.

And when the Suez Canal got blocked, international freight’s day went from bad to shouldn’t have even gotten out of bed.

Which brings us to today...

Amazon distribution woes and international freight challenges are a reality. They aren’t going anywhere; much like ecommerce traction won't be retracting. For Amazon FBA sellers, this means fulfillment and freight must be managed and accounted for, not ignored.

So despite the challenges of the last year, here’s seven things we identified internally that smart importers - and especially Amazon importers - should remember when sourcing, importing, and managing their fulfillment.

Sourcing Smart

Source with the times. When we looked at the data of importers that grew quickly during COVID, we found a cohort of sellers that were incredibly fast to adapt to new realities. Within just a month, health and medical expanded to a full 7% of all goods imported on our platform. Much like the larger retailers that shifted to manufacturing masks, responding to market needs works. This is not just pandemic behavior. We saw the same behavior when fidget spinners were briefly popular. Incidentally, this remains a huge advantage for ecommerce sellers; many Amazon vendors were stocking fidget spinners long before Toys R Us (RIP).

When sourcing, landed cost is everything. If the only way to get a product to Amazon is by air cargo, or if import duties are more than an importer estimates, a product can quickly go from hero to zero. When possible, lean towards smaller and resilient products. And, of course, get the right document, HS codes, and any other input you can get from your supplier, forwarder, or customs broker to make sure that you won’t get nickeled and dime on freight.

Fabulous Fulfillment

Non-Amazon Storage.. Whether it’s because of SKU limitations or because storing all your inventory in FBA centers costs a lot, having a non-Amazon storage facility that you can trust to store and ship to Amazon can be a good way to only pay what you need to for storage.

Diversify fulfillment options. Depending on the company lifecycle, consider diversifying beyond using Amazon as an exclusive distribution channel. Obviously, all the sales you’ll ever need are on Amazon and, granted, the pandemic was a once-in-a-lifetime event (hopefully), but when all of your fulfillment eggs are stored in Amazon’s baskets and they shut down fulfillment or inbound shipping for your business, bad things happen. Mostimporters - over 80% - on our platform are still all in on one distribution channel, but we’re seeing them broaden their scope.

Freightastic

Mix modes. Many importers tend to fill gaps in their supply chains with a one-size fits all solution. But if there’s inventory that needs to be replenished fast, consider splitting shipments and moving some by air cargo (or express, if it’s small and really urgent) with the rest to follow by ocean. Even on the ocean side, if space is at a premium, try an LCL (less-than-container load) shipment to cover gaps while holding off a bit for 40 full feet of your product.

Calendar check. COVID was a strange year for global freight. April is typically a low point in ocean freight prices, but as I write this, China-US 40’ container prices are over $5,000, compared to $1,530 at the same time last year. There are particular times of year when prices are expensive - right before and after Chinese New Year, right before Dragon Boat holiday in China, and beginning in July as peak season prices begin to apply. In addition, prices for ocean freight get bumped up in high season on the 1st or 15th of every month, while dropping on the same days during weaker seasons.

Shop around. As part of our research, we try to get freight quotes from the 20 largest freight forwarders using a fake company once a year. We typically find that even for a small LCL shipment, price ranges can be well over 60%. This isn’t (usually) because forwarders are trying to make a quick dime. It’s because each has their own cost structure, carrier relationships, and capacity they need to fill. Look around, even if it’s just to keep your provider honest. Freightos keeps a weekly FBA freight index to measure costs to a bucket of FBA centers in the US but you can also compare prices across dozens of forwarders in real-time at ship.freightos.com. Do it - I don’t even mind if you book - to make sure you’re getting competitive service and prices.

And last but not least, stay educated. If you’ve read this, it means that you’re diving deeper than many other sellers, which means you’re already on the right track.

Here’s to freight challenges that remain in meme-land, successful sales, and smooth shipping.

About the Author

Eytan Buchman loves freight so much he shouts out container sizes while he walks around. He's obsessed with content marketing, data storytelling (it's a thing!) and bakes really good cookies. He's the Chief Marketing Officer at the Freightos Group, which runs Freightos, the world's largest online freight marketplace, and WebCargo, the digital network connecting logistics providers with airlines and ocean liners. When he's not thinking about pallets, he hosts the Marketers in Capes podcast, and consults to a number of startups and nonprofits. He still likes Minidisc players and has never skied. Ever.

PLUS don't forget to signup for my newsletter Amazon Insiders and start receiving weekly tips and hacks to help you dominate on Amazon!

Individuals frequently wonder 'Why is solar based energy great?' and, thus, neglect to understand the significance of solar powered innovation https://sunmaxsolar.sitey.me/. Solar based power has clearly turned into the pattern in environmentally friendly power. Property holders around the UK introduced solar powered chargers on their rooftop, overseeing likewise to harvest all the solar oriented energy benefits.

Facebook is a person to person communication specialist organization. It allows you to welcome and interface with companions facebook smm panel, send messages and pictures, as and remark or offer them. Facebook has seen extraordinary development since its initiation and is ready to keep up with its strength in informal communication.

Before you start utilizing your Fire television Stick pair firestick remote, you'll need to coordinate the remote. The interaction can differ contingent upon which model you have, and only one out of every odd remote is exchangeable with every age of Amazon Fire television. This is the way to coordinate or reset your Fire television Stick remote.